Carmignac appoints top-performing equity Manager for Flagship Strategies

Carmignac has appointed Kristofer Barrett, a top-performing global equities manager to its London-based investment team. He will join the business on 8 April 2024.

Kristofer will take over management of the Carmignac Investissement strategy and the equity portfolio of the Carmignac Patrimoine strategy. Kristofer will also join the firm’s strategic investment committee.

This appointment coincides with the decision by David Older to retire. He will leave the business on 4 April 2024. Mark Denham, an accomplished equities investor who has managed European and global equity funds at Carmignac since 2016, will become head of equities.

On the Carmignac Patrimoine strategy, Kristofer will work alongside two expert duos, in line with the strategy’s team approach, consisting of three performance drivers (equity selection; fixed income and currency management; and macro-overlay, portfolio construction and risk management).

Kristofer is a US and Swedish national. He studied business and finance at Uppsala University and joins Carmignac from Swedbank Robur, where he worked since 2006 running several developed and emerging market equity funds. In April 2016, Kristofer took over management of a now Morningstar five-star rated €10 bn global equities strategy and in March 2020, he was appointed manager of a now Morningstar five-star rated €12.8 bn technology equity strategy1.

Kristofer is a seasoned, active stock picker. His proven approach of combining in-depth company research with pragmatic macro analysis has resulted in an outstanding long-term track record. During his tenure as manager of the global equity fund (starting April 2016) he delivered an outperformance of 133% and 145% versus the index and category average, and assets grew nearly five-fold2. Similarly, during his management of the technology equity fund (starting March 2020) the fund outperformed the index and category average by 105% and 89% and assets nearly tripled3.

Edouard Carmignac comments: “Kristofer’s appointment is a testament to Carmignac’s attractiveness to entrepreneurial-minded individuals, with a passion for active, conviction-driven investing. His track record is extremely impressive and I’m convinced his tried and tested process will prove to be highly beneficial for our clients over the long term.

I’d also like to thank David Older for his contribution to the business. He’s played an integral role in the development of Carmignac’s equity structure. I’d like to wish him the best for the future.”

Kristofer Barrett adds: “The coming years are set to be pivotal for equity markets. I am convinced that active management – and the ability to put conviction investing to work - is the key to success in this changing environment. Carmignac is renowned for its contrarian approach and I look forward to joining its accomplished fund management team.”

David Older concludes: “After nine fulfilling years at Carmignac, now is the right time for me to retire. I’m leaving the team, and funds, in safe hands and look forward to watching Carmignac’s continued success.”

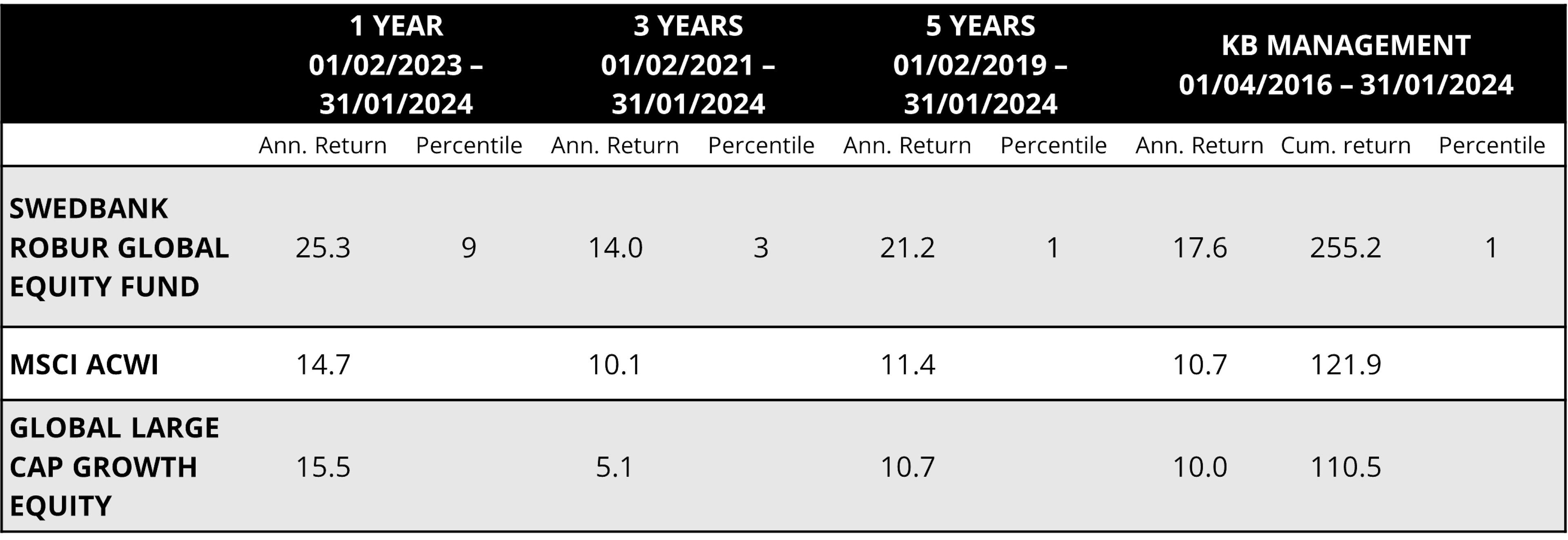

Performance of Kristofer Barrett’s Swedbank Robur funds

Past performance is not a guide to future performance

201/04/2016 – 31/01/2024. Strategy = 255.2% Index (MSCI ACWI) = 121.9%, Category average (Global Large Cap Growth Equity) = 110.5%. Assets = €1.8 bn to €10 bn. Performance measured in Euro.

301/03/2020 – 31/01/2024 .Strategy= 140.6%, Index (MSCI World/IT Services) = 35.9%, Category average (Sector Equity Technology) = 51.9%. Assets = €4.6 bn to €12.8 bn. Performance measured in Euro.

Carmignac Patrimoine A EUR Acc

- Horizonte de investimento mínimo recomendado

- 3 anos

- Escala de Risco*

- 3/7

- Classificação SFDR**

- Artigo 8

*Escala de Risco do KID (documentos de informação fundamental). O risco 1 não significa um investimento isento de risco. Este indicador pode variar ao longo do tempo. **O Regulamento SFDR (Sustainable Finance Disclosure Regulation) 2019/2088 é um regulamento europeu que exige aos gestores de ativos que classifiquem os seus fundos como, entre outros: «Artigo 8» que promovem as características ambientais e sociais, «Artigo 9» que fazem investimentos sustentáveis com objetivos mensuráveis, ou «Artigo 6» que não têm necessariamente um objetivo de sustentabilidade. Para mais informações, visite: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=pt.

Principais riscos do fundo

Ações: O Fundo pode ser afetado por variações nos preços das ações, numa escala que depende de fatores externos,

volumes de negociação de ações ou capitalização bolsista.

Cambial: O risco cambial está associado à exposição a uma moeda que não

seja a moeda de avaliação do Fundo, através de investimento direto

ou do recurso a instrumentos financeiros a prazo.

Comissões

- Custos de entrada

- 4,00% do montante que paga ao entrar neste investimento. Este é o valor máximo que lhe será cobrado. Carmignac Gestion não cobra custos de entrada. A pessoa que lhe vender o produto irá informá-lo do custo efetivo.

- Custos de saída

- Não cobramos uma comissão de saída para este produto.

- Comissões de gestão e outros custos administrativos ou operacionais

- 1,50% O impacto dos custos que suportamos anualmente pela gestão dos seus investimentos e outras comissões administrativas. Esta é uma estimativa baseada nos custos efetivos ao longo do último ano.

- Comissões de rendimento

- 20,00% O montante efetivo irá variar de acordo com o desempenho do seu investimento. A estimativa de custos agregados acima inclui a média dos últimos 5 anos, ou desde a criação do produto, se for inferior a 5 anos.

- Custos de transação

- 0,79% O impacto dos custos inerentes às nossas operações de compra e de venda de investimentos subjacentes ao produto.

Insights mais recentes

Convening Notice of the Annual General Meeting of Shareholders