Flash note

The main convictions of Carmignac Portfolio Global Bond

- Publicado

-

Duração

7 minutos de leitura

The current environment, characterized by rising interest rates, high inflation and increasing geopolitical risks, is a major challenge for most bond investors. In this context, and in order to navigate on this new geopolitical and monetary order, it is therefore crucial to have the ability to invest across all fixed income and currencies assets.

Investment Philosophy & Key Selling points

We believe that Carmignac P. Global Bond has the tools to meet these macro-economic and financial challenges, notably through:

-

- A global investment universe that allows us to identify macro-economic trends around the world. This allows us to invest in all geographical areas and to take advantage of any macroeconomic asynchrony across all eligible assets.

- A multitude of alpha sources across all bond sub-sectors, including interest rates, credit and currency strategies in both developed and emerging markets.

- A flexible and unconstrained investment process that aims to "cross the cycles" that employs both long and short strategies to optimize performance while mitigating risk in all market conditions, enabling us to meet our clients' current challenges.

- A global investment universe that allows us to identify macro-economic trends around the world. This allows us to invest in all geographical areas and to take advantage of any macroeconomic asynchrony across all eligible assets.

As a reminder, our main investment guidelines are as follows:

- Modified duration: -4 to 10.

- Structured credit exposure: 0 to 10%.

- Credit derivatives: 0% to 30% (on iTraxx and CDX indices).

- FX: FX strategies can be either a performance driver or a risk management tool.

Finally, the fund's Portfolio Manager, relies on the contributions of the entire Fixed Income investment professionals’ team at Carmignac, which is composed of around 20 people, including analysts, economists and portfolio managers.

Current macro-economic trends

As geopolitical risks become more and more localized, we observe the resurfacing of the challenges which the global economy was already facing before the escalation of the Ukraine-Russia war.

At a glance, in the face of increased, persistent and widespread inflation, hawkish central bankers, rising yields, slowing global growth and geopolitical uncertainties the risk of slowflation is more tangible than ever. Given such prospects we have identified three main concerns that have and will continue to affect investors over the coming months.

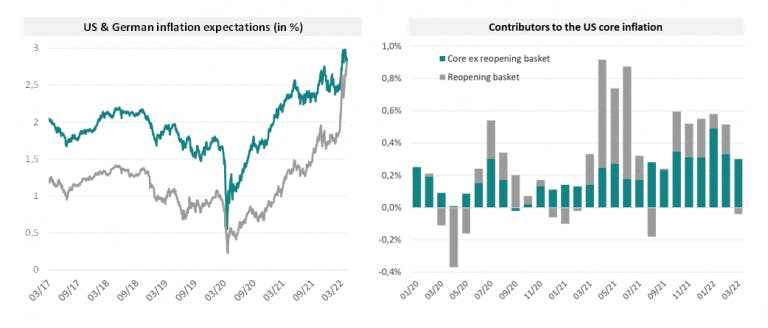

1. We see global inflation become more and more persistent as we go

The past decade was clearly marked by a trend of low global growth and deflationary forces. It is also these deflationary forces that drove most central banks’ very accommodative policies, to which we easily got accustomed to. Consequently, in the past decade (ending in 2020-2021), we had on the one hand fixed income markets continuing their bull trend, while on the other hand commodities and certain currency baskets for instance, performed poorly (in relative terms).

This global picture has dramatically changed as of late. What we have witnessed in recent months is that overall inflation has not only increased but also expanded (in terms of affected sectors). It is no longer confined to a few COVID-sensitive sectors but now includes areas and categories in which elevated rates of inflation tend to stick around for longer, hence become more persistent going forward.

On top of which, come cost pressures notably linked to commodity prices and supply chain disruptions resulting from the Russia-Ukraine crisis or the Chinese zero-Covid lockdown policies. These are undoubtfully adding more stress to this already volatile trend.

We now expect inflation to be past peak levels, therefore inflecting, but persistently above the 2% threshold throughout 2022 and into 2023.

So, in a context of rising interest rates but persistently strong inflation, fixed income investors are left with little options in the short run that help to pass through the storm. Certainly, commodities or commodity linked assets (such as selected currency baskets) have so far proven successful.

Market implications: The main takeaway in the current context seems to be the unavoidable hawkishness of the Federal Reserve. In fact, the Fed wants to bring inflation down at any cost. It directly implies, lower growth, hence lower equities, and potentially further widening credit spreads. As a matter of fact, for now, central bankers seem to have made their choice between inflation and growth.

2. The “Commodity Super-Cycle” reflected in currency baskets

As mentioned above, commodities follow ‘super-cycle’ trends which tend to be ‘longer than’, and ‘less related to’ economic cycles. The last commodity super-cycle (2002 – 2008) for instance was mainly driven by demand (the latter fed itself by Chinese economic ‘super growth’ and that of Emerging Market countries more broadly of course).

We are now at the beginning of a new commodity upswing, driven by supply, which has started in our view in 2020 and will most likely drive the new macro-economic regime with notably: stronger inflation and more hawkish central banks (at least in the short run) etc.

And while, the recent geopolitical events have ‘tactically’ strengthened this bull commodity super-cycle, (gas and oil but also agriculture commodities’ prices are a good example, since cereals and fertilizers are among the most exposed to the Russian conflict in Ukraine) – On the longer run, commodities will also be supported by the green revolution. Having said that, currently we remain cautious with regards to the situation in China as the countries zero-covid policy could directly affect demand on commodities and hence prices.

Lastly, in our view, this commodity super-trend should continue put aside any short-term gas and oil price-fluctuations, Chinese slow-down related demand, or surprising developments of the geopolitical order.

Market implications: The Latin American countries for instance, have benefited from the rise of oil and gas but also from "soft commodities" prices (i.e. corn, wheat, soyabeans, etc.) following the disruptions of production in Ukraine, which was one of the largest producers of wheat and corn worldwide. Hence countries such as Brazil, Chili, Colombia, Uruguay, Mexico were positioned among the front-runners.

The first assets to have reacted are in fact currencies which are closely correlated to commodity cycles and highly liquid. Latin American currencies for instance have indeed outperformed other Emerging Markets regions, especially at the peak of the crises (but not limited to this period).

This upturn has profited to the performance of our Carmignac Global Bond fund and strategy thanks to our long positioning in FX strategies during Q1 2022 (whether it be our long positions on commodity related Latin American currencies or our long positioning on the Canadian dollar or our shorts on the Yuan and other related Asian currencies for instance). Note, that we decided to tactically take our profits on our main commodity-linked currencies positions.

3. Geographical dissonance and growth differential

The macro-economic horizon is not looking exactly similar for each of the main economic blocks and regions whether it be in terms of growth prospects, inflation forecasts or monetary policies.

And while the Q1-2022 is making bond market history with notably the largest quarterly increase for the US 2-year Treasury yields, most Emerging Market countries are on the other hand giving hints of an ending hiking cycle.

In that sense, central banks in Latin America for instance were the first ones to end monetary easing as soon as Q1 2021. This perspective on the current level of yields and the path for interest rates going forward is an additional support for local assets on the mid to long-term (the first one being in our view commodities).

Inflation is yet another example of continued desynchronization (but also closely linked to global growth and central banks policies). We notice that inflation in Asian countries for instance (or even in other regions of the world, such as Israel) remains relatively low. And while we still believe that global inflation will “pinch on” global growth prospects, it is also clear that the story varies somehow from country to country.

Finally, GDP numbers and forward-looking prints, also seem to contrast.

- On one hand, the United States and Canada are still posting decent growth figures (although on a slowing trend);

- Europe remains very fragile and ‘commodity-prices-dependent’ and therefore paying the highest toll in terms of consequences from the Russian invasion of Ukraine;

- Lastly, China is once again hit by a large scale close-down as Omicron infections skyrocket which would certainly impact its growth forecasts going forward with the very disappointing recent PMI figures published in China. It also raises some questions on up-coming “deja-vu” supply chain bottlenecks.

Positioning & Performance drivers

Where does it leave us in terms of positioning? Our current positioning is in line with the above identified trends.

Carmignac Portfolio Global Bond A EUR Acc

Horizonte de investimento mínimo recomendado

Risco mais baixo Risco mais elevado

. .

CRÉDITO: O risco de crédito consiste no risco de incumprimento do emitente.

TAXA DE JURO: O risco de taxa de juro resulta na diminuição do valor patrimonial líquido no caso de variações nas taxas de juro.

CAMBIAL: O risco cambial está associado à exposição a uma moeda que não seja a moeda de avaliação do Fundo, através de investimento direto ou do recurso a instrumentos financeiros a prazo.

GESTÃO DISCRICIONÁRIA: Previsões de alterações nos mercados financeiros feitas pela Sociedade Gestora surtem um efeito direto sobre o desempenho do Fundo, o qual depende das ações selecionadas.

Este fundo não possui capital garantido.

Carmignac Portfolio Global Bond A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Desde o início do ano até à data |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Global Bond A EUR Acc | +13.78 % | +3.33 % | +9.46 % | +0.10 % | -3.66 % | +8.36 % | +4.70 % | +0.12 % | -5.56 % | +3.02 % | +2.35 % |

| Indicador de Referência | +14.63 % | +8.49 % | +4.60 % | -6.16 % | +4.35 % | +7.97 % | +0.62 % | +0.60 % | -11.79 % | +0.50 % | +3.53 % |

Deslocar para a direita para ver a tabela completa

| 3 anos | 5 anos | 10 anos | |

|---|---|---|---|

| Carmignac Portfolio Global Bond A EUR Acc | -0.15 % | +0.71 % | +2.29 % |

| Indicador de Referência | -3.37 % | -1.78 % | +1.35 % |

Deslocar para a direita para ver a tabela completa

Fonte: Carmignac em 29/11/2024

| Custos de entrada : | 2,00% do montante que paga ao entrar neste investimento. Este é o valor máximo que lhe será cobrado. Carmignac Gestion não cobra custos de entrada. A pessoa que lhe vender o produto irá informá-lo do custo efetivo. |

| Custos de saída : | Não cobramos uma comissão de saída para este produto. |

| Comissões de gestão e outros custos administrativos ou operacionais : | 1,20% O impacto dos custos que suportamos anualmente pela gestão dos seus investimentos e outras comissões administrativas. Esta é uma estimativa baseada nos custos efetivos ao longo do último ano. |

| Comissões de rendimento : | 20,00% quando a classe de ações supera o indicador de referência durante o período de desempenho. Será pago também no caso de a classe de ações ter superado o indicador de referência, mas teve um desempenho negativo. O baixo desempenho é recuperado por 5 anos. O valor real varia dependendo do desempenho do seu investimento. A estimativa de custo agregado acima inclui a média dos últimos 5 anos, ou desde a criação do produto se for inferior a 5 anos. |

| Custos de transação : | 1,36% O impacto dos custos inerentes às nossas operações de compra e de venda de investimentos subjacentes ao produto. |